2nd all-funds budget aligns priorities

After closing a $300 million deficit, the University presents a FY24 plan that supports fiscal responsibility and strategic goals.

Once you’ve projected a balanced budget the first time, it’s a little easier to do it again.

Ask Nathan Knuffman, who came into his job as vice chancellor for finance and operations and chief financial officer facing both a $100 million shortfall and a $200 million pandemic-related impact and produced the University’s first all-funds balanced budget last year.

This year, Knuffman stuck to a winning formula and presented a $4.2 billion all-funds budget for FY24 (July 1, 2023 to June 30, 2024). The budget still balanced, even with slightly less revenue, and was approved by the University’s Board of Trustees in April. It was presented for final review by the UNC System Board of Governors at its meeting on May 25.

“We’ve elevated the conversation around finance toward our goals and our priorities, and it’s helped us act with more confidence, more strategically,” Knuffman said. “Last year was a good first step. This second year, we’re continuing to see the process mature and build support and trust in it.”

Behind the Numbersis a series that takes an in-depth look at the figures and policies that make up Carolina’s finances. We aim to shed light on the University’s financial situation, how various financial buckets fit together and what policies guide decision-making.

Key to building trust in the model has been the emphasis on transparency throughout. The University’s first all-funds budget generated its first Annual Operating Budget Book, a detailed description of the numbers and the process that produced them. UNC System President Peter Hans distributed the budget book to all the other campuses within the system as a model, Knuffman said.

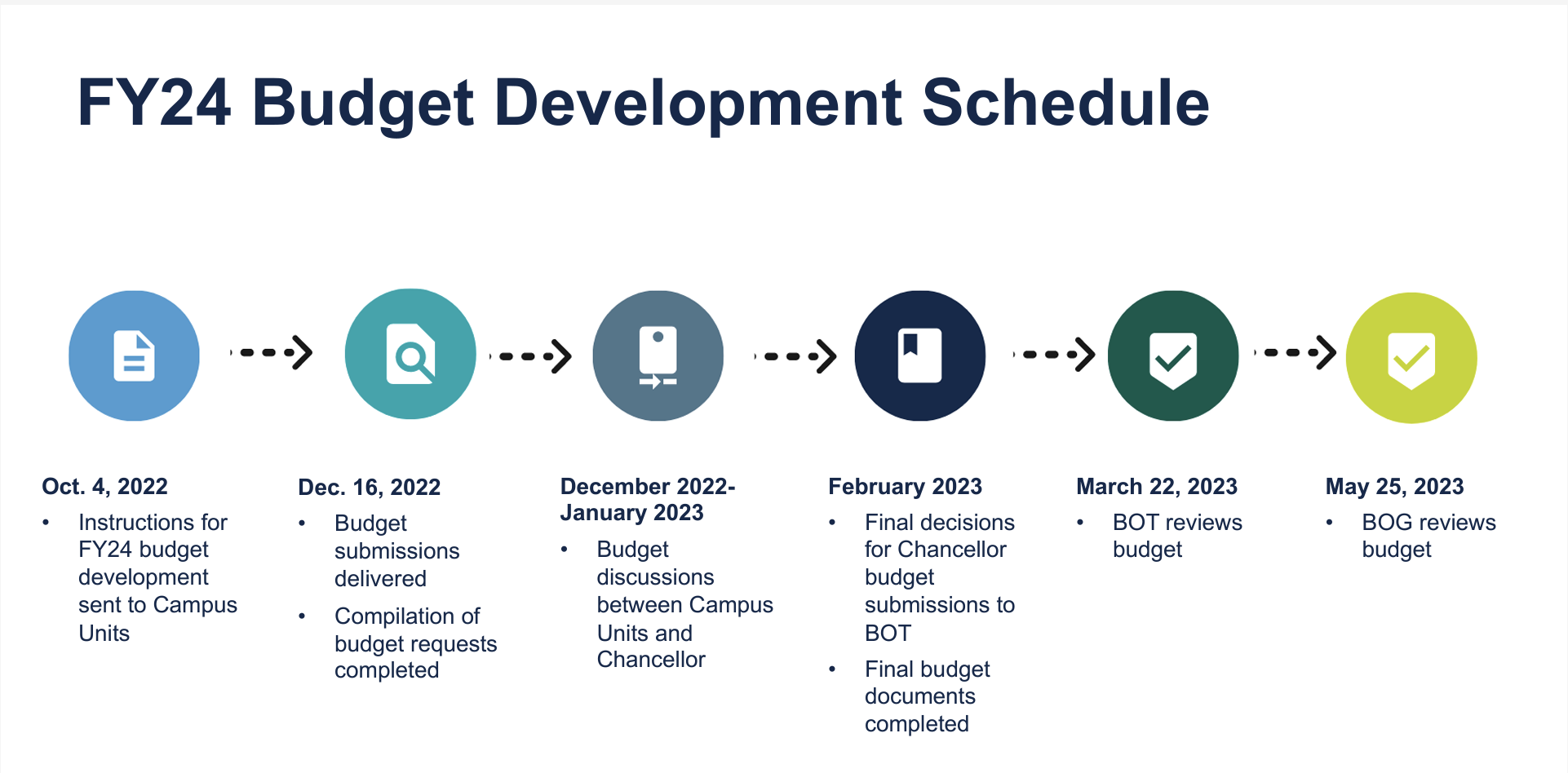

The budgeting process opened up even further in the development of the FY24 plan as Chancellor Kevin M. Guskiewicz, Knuffman and other campus leaders committed to more than 30 budget meetings with individual campus units, starting last fall.

“Last year we didn’t have the opportunity to meet with every campus unit. This year we prioritized that, and a stronger budget plan emerged,” Knuffman said.

Aligning budget with priorities

For the FY24 plan, revenues were down slightly but so were requests for additional funding. Campus units requested a total of $108 million, down from $173 million last year, largely because of reinvestments in recent years that addressed many needs, Knuffman said.

Discussions at a senior leadership retreat led to the selection of four budget priorities aligned with Carolina Next, the University’s strategic plan: fiscal responsibility, career development, discovery and service to society.

“A budget is a plan, and it’s a high-level plan, so it should reflect the top strategic priorities of the institution,” Knuffman said. “These four got elevated through the process. The budget is a deliberate effort to link resources to those top priorities.”

Here’s how those priorities were reflected in the budget:

Fiscal responsibility

- Balanced budget that grew at a rate below inflation.

- Reserves for contingencies.

- No tuition increases for undergraduate residents and no fee increases.

- Investments in risk mitigation, such as an increase in audit staff.

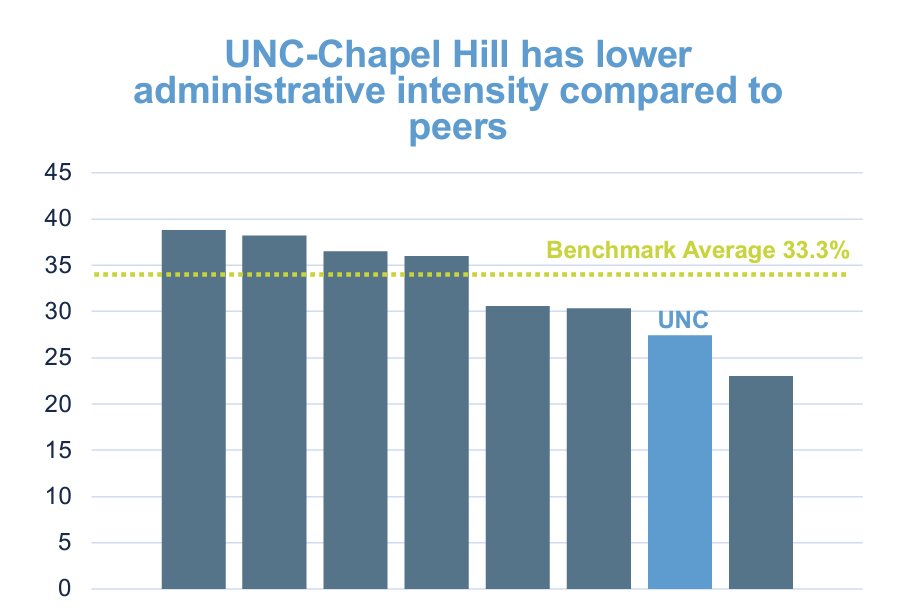

- Administrative efficiencies and savings, such as less money spent on leases.

Career development

- Enrollment increase to meet critical workforce needs in nursing, mental health, social work and data/computer science.

- Expansion of career planning services.

- Increased accessibility and student support resources.

- Creation of a financial literacy and wellness center.

- Graduate student stipend increases.

Discovery

- Reserves for pan-campus research infrastructure investments.

- Operational support for N.C. Collaboratory and other research enterprises.

- Investment in innovation through University start-ups and support for the Eshelman Institute for Innovation.

Service to society

- Increased resources to meet demand for data/computer science.

- Funding for admissions and community outreach officers.

- Support for Carolina Across 100 initiative.

- More finance training and resources for small local government units.

- Investment in the local economy through projects like Porthole Alley and the Innovate Carolina Junction hub on Franklin Street.

The Innovate Carolina Junction is now open in the newest building in downtown Chapel Hill at 137 E. Franklin St. (Sarah Daniels)

Because of reserves set aside for contingencies, Knuffman was able to respond quickly to specific funding requests from the University’s Board of Trustees at its March meeting. The final budget included an additional:

- $5 million for campus accessibility projects.

- $4.4 million for continued build out of School of Data Science and Society.

- $2 million for curriculum development to support a School of Civic Life and Leadership.

- $1 million for ongoing lead testing and remediation.

- $0.5 million each for IT review and operational support for the School of Dentistry.

Looking forward and back

In addition to the FY24 plan and the FY23 operating budget report, Knuffman’s office has also published a new Annual Comprehensive Financial Report that looks back at FY22. While much of his efforts recently have focused on forward planning, he said it is also important to review how funds were spent.

The budget and the financial report are “complementary ways to monitor fiscal health,” he said. “We’re very proud of the fact that our annual report has shown great progress in terms of financial management in the last two years.”

He points to the Composite Financial Index, a measurement of the University’s overall financial health, based on a 10-point scale. Carolina scored 9.35 in FY21 and 8.32 in FY22, compared to 4.43 in FY20 and a decade-low 3.14 in FY16. “In the last two years, you can see that we have had the strongest results we’ve had there in more than a decade.”

Knuffman’s approach was also validated by a AAA rating from Moody’s Investor Service, which cited the all-funds budget as a reason it gave the University its top rating for creditworthiness, announced in March.

The University has come a long way toward fiscal strength in a short time.

“We were facing a large structural shortfall, a lot of uncertainty due to the economy, a pandemic with uncertain impacts,” Knuffman said. “We realized the institution needed to be able to have a better understanding of its finances, its key drivers and a way to discuss those in common terms. That template proved very successful.”